CAPITOX

FUNDAMENTAL FUND

ABOUT FUNDAMENTAL FUND

CapitOx Fundamental Strategies Fund (FSF) is Oxford’s premier equity long-only student managed investment fund. Our fund comprises of over 30 Fund Analysts and Portfolio Managers - most of whom graduated from our Finance Academy and/or have prior finance experience. Our live FSF also gives students practical experience on how to manage a student portfolio with real money being traded.

Programme

Offerings.

-

Analysts work under experienced Project Leaders and Directors to gain exclusive insights in the fundamental investing process.

-

Our weekly classes teach you how to build near industry-standard technical models, including DCF, 3FS, and advanced revenue builds.

-

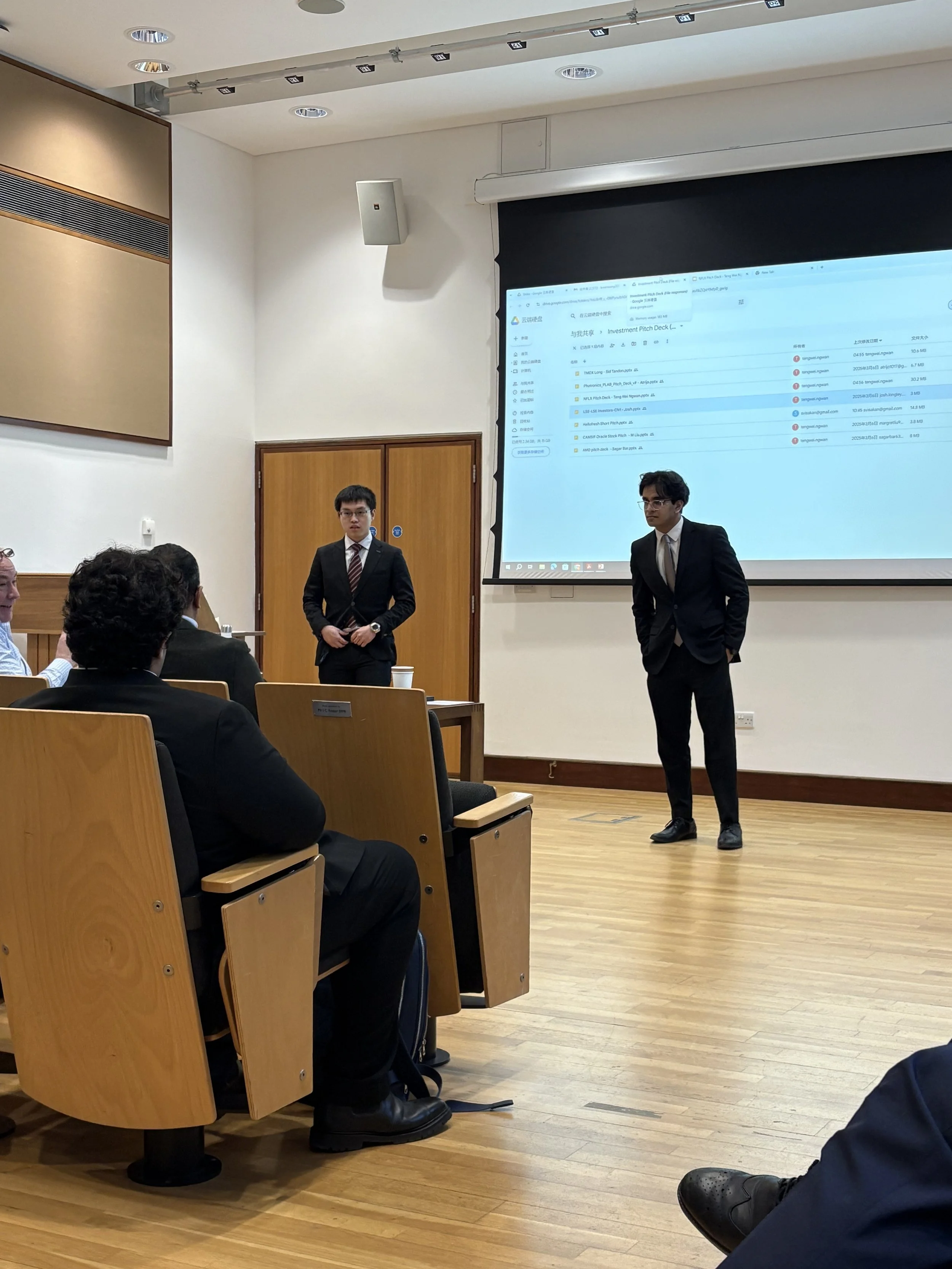

Teams of 5-6 work to put their knowledge to the test in a final pitch, judged by former alumni and partners from hedge funds.

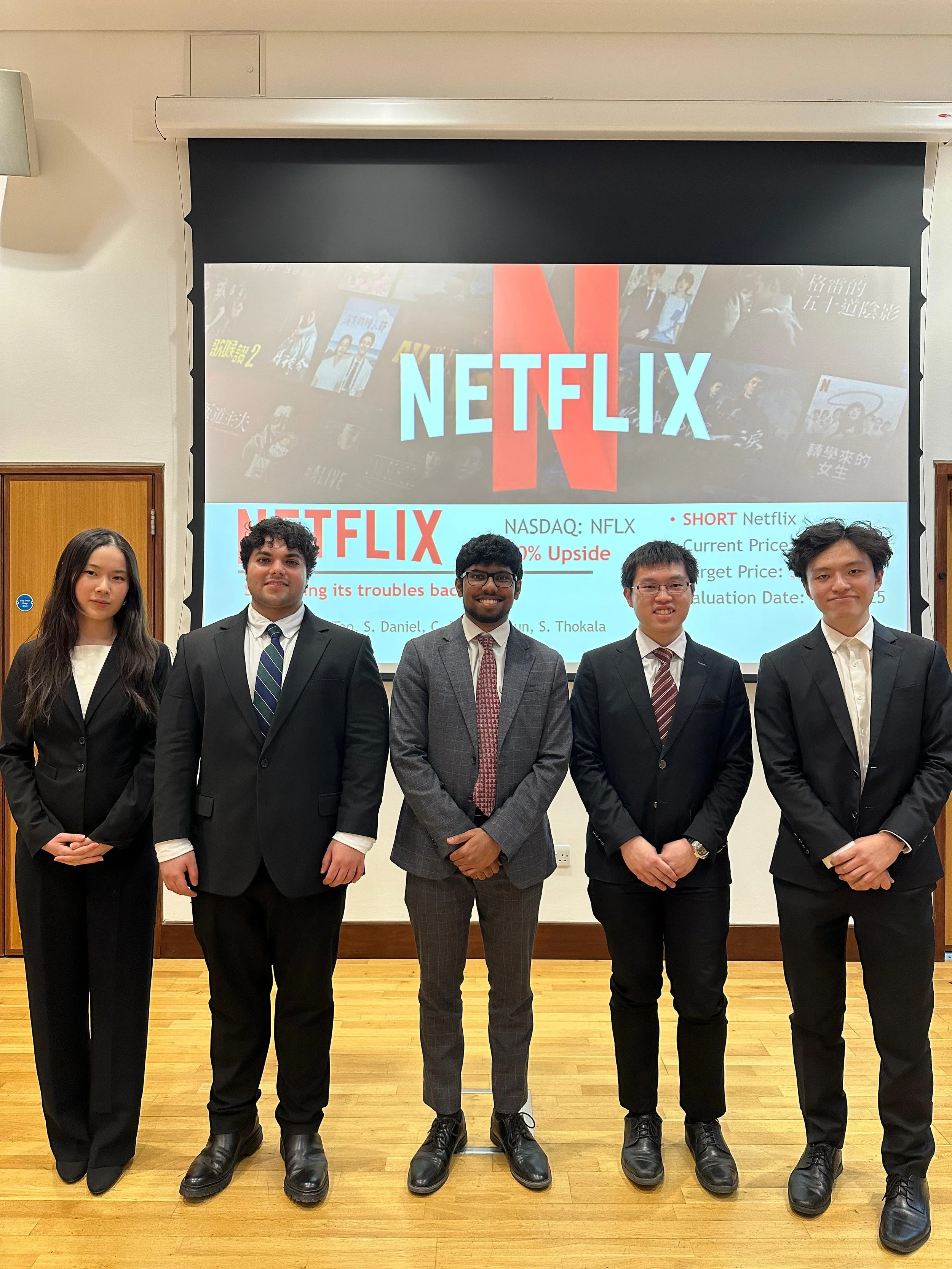

HT25 Competition Winners: A Short on Netflix

We proposed a short recommendation of Netflix (NFLX). While the market perceived Netflix as having won the streaming wars, our contrarian view identified headwinds that the market was missing. With predictions of subscriber growth slowing, pricing power fading, and advertising efforts underwhelming, we argued that Netflix was overvalued by over 40%, trading at a 52x P/E multiple - on par with Nvidia - despite facing fierce competition and limited room for expansion.

Some things that ultimately gave us the edge in the competition included sentiment analysis using Python, running a full DCF valuation with scenario analysis (37 builds across geographies and pricing outcomes) and constructing a reverse DCF to show how implausible the market’s assumptions were. Our valuation incorporated macro headwinds, CPM erosion, and subscriber churn linked to price sensitivity, producing a base case target of $619.13, well below its market price of $1,027.31.

The competition was a valuable yet challenging opportunity to pitch against top teams from across the UK like CAMSIF and LSE, while also those with students flying in from the United States. We were proud to receive strong feedback from the judges, with one remarking that our time-mapped catalyst analysis and integration of expert interviews demonstrated a level of depth and rigour they would not even expect from a first-year analyst.

APPLY TO

BECOME A

FUND ANALYST

-

Fund Analysts will be part of a sector team that comes up with one stock pitch per term. Teams identify the most attractive investment opportunities by sector, using research tools like Capital IQ and Bloomberg that professionals utilise on a day-to-day basis. Our strongest fund analysts have graduated to top investment firms. Fund Analysts spend 2-8 hours a week, with the distribution of work tending towards Week 7 & 8, when analysts are preparing to pitch their stock to a panel of external judges.

Our Trinity Term Pitch Day was judged by Ben Uglow, an ex-Morgan Stanley MD, and Farzad Limki, a Portfolio Manager at Millenium. Analysts can expect to conduct and see through the full investment process - from ideation, industry analysis, complete financial modelling (DCF, 3-Statement), pitching, positioning, and investment follow-up. Portfolio Managers work on analyst development and contribute to the teams equally. Most importantly, you can look forward to a whole slew of socials and events throughout the term - last term saw Junkyard Golf, Poker, Pizza and several team dinners! -

We are looking for students who have some experience in financial modelling, and who are eager to learn more about Investment Banking and finance in general. Skills in Excel and PowerPoint are ideal but not necessary. Most importantly, we are looking for students who are eager to learn, work in a team, and forge strong friendships.

-

Applications for Hilary 2026 are now open.